Managing your finances as an author is essential for long-term success.

At Beverly Hills Publishing, we understand the unique financial challenges authors face.

In this blog post, we’ll provide practical advice on budgeting, revenue streams, and saving strategies tailored for authors.

How to Budget

Effective budgeting is a cornerstone of financial stability. Without a clear budget, it’s easy to lose track of earnings and overspend.

Tracking Income and Expenses

Start by meticulously tracking all income and expenses. Use a reliable tool like QuickBooks or an Excel sheet. For instance, record every book sale, speaking engagement fee, and royalty check. Likewise, note down all expenses, including marketing costs, office supplies, and software subscriptions.

Setting Financial Goals

Next, define your financial goals. Whether it’s saving for a new laptop or funding a marketing campaign, specific goals help build a roadmap for your budget. According to a study by the Certified Financial Planner Board of Standards, people who set financial goals are 83% more likely to feel better about their finances after one year.

Creating a Monthly Budget

Formulate a monthly budget that aligns with your financial goals. Allocate funds for essentials such as rent, utilities, and groceries. Then, set aside money for professional needs like editing services or website maintenance. Reserve a portion for savings and unexpected costs. Tools like YNAB (You Need A Budget) can simplify this process.

Practical Tips

-

Automate Your Savings: Set up automatic transfers to your savings account to avoid spending your reserves.

-

Track Subscriptions: Keep an eye on recurring expenses like software subscriptions. Cancel what you don’t use often.

-

Monitor Cash Flow: Regularly review your budget to adjust for fluctuating income and unexpected expenses.

By maintaining a detailed budget, you can focus more on your writing and less on financial stress.

For more insights on building a sustainable financial strategy, check out our long-term strategy guide.

How Can Authors Diversify Their Income?

Diversifying income streams is a smart strategy for authors to increase revenue and achieve financial stability. There are several avenues authors can explore.

Traditional Publishing vs. Self-Publishing

Traditional publishing can offer large advances and robust distribution but comes with long waiting times and less control over your work. According to Authors Guild, the median income for traditionally published authors was higher at $6,080 compared to $1,525 for self-published authors. However, the latter can keep 70% of sales revenue on platforms like Amazon Kindle Direct Publishing (KDP).

Self-publishing offers higher royalties and complete creative control. Authors can publish quickly and have a more direct relationship with readers. However, they must also manage all marketing and distribution efforts. Choose the route that aligns with your goals and resources.

Royalties and Advances

Traditional publishing may offer advances, but these are typically modest, ranging from $1,000 to $10,000 for first-time authors. Royalties in traditional publishing usually range from 5% to 15% of book sales.

In contrast, self-published authors can earn up to 70% royalties on eBooks sold through platforms like Amazon KDP. Diversify your formats by offering eBooks, audiobooks, and print versions to maximize your revenue.

Leveraging Online Platforms and Merchandise

Engage with readers through various online platforms to create additional revenue streams. Platforms like Patreon offer subscription options where fans pay for exclusive content. By providing behind-the-scenes insights, early access to new works, or special Q&A sessions, you can create a consistent income.

Authors can also create and sell merchandise related to their books. Custom merchandise can include anything from bookmarks, tote bags, and posters. Using websites like Etsy to reach a broader audience can be lucrative.

Tips for Maximizing Revenue

-

Utilize Multiple Platforms: Offer your books on various platforms like Amazon, Barnes & Noble, and Kobo to reach wider audiences.

-

Experiment with Formats: Provide your books in different formats, including audiobooks and eBooks.

-

Engage with Readers: Use social media and email lists to maintain a connection with your readers. Engaged readers are more likely to buy your new releases and recommend them to others.

-

Create Subscription Services: Leverage platforms like Patreon to offer exclusive content for a monthly fee.

-

Offer Workshops and Courses: Share your expertise by conducting writing workshops or online courses.

By diversifying your income streams, you can build a more sustainable financial future. It’s also important to stay updated on the latest publishing trends and techniques that can help maximize your revenue.

Saving and Investing

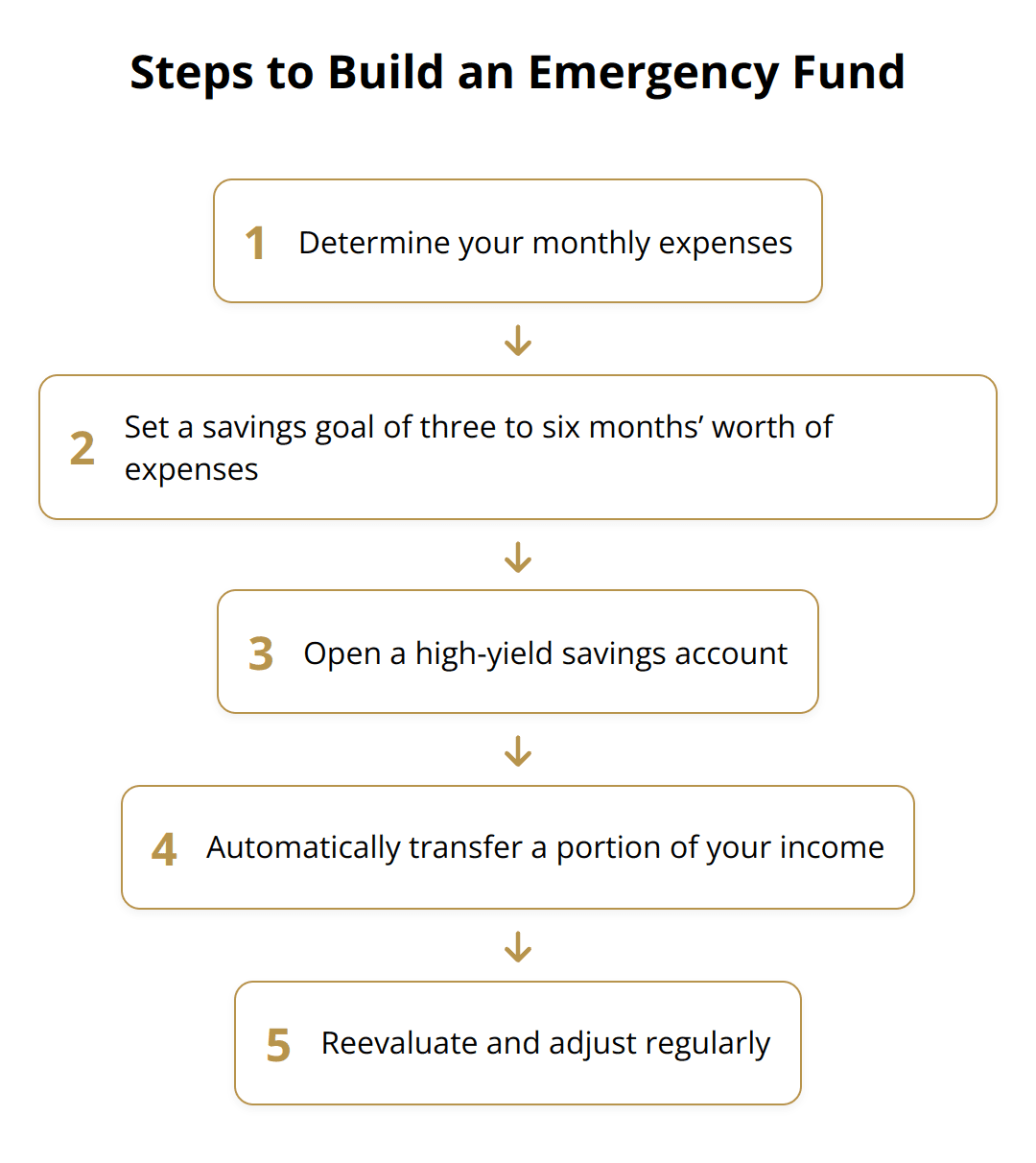

Building an Emergency Fund

An emergency fund is essential for financial stability. Aim to save at least three to six months’ worth of living expenses. This fund acts as a buffer during unexpected situations, such as medical emergencies or sudden loss of income. According to a recent survey, 69% of households have less than $1,000 in emergency savings. An ideal place to keep this fund is a high-yield savings account, offering both safety and accessibility.

Retirement Savings Options

Authors need to plan for their retirement just like anyone else. Traditional options like IRAs and 401(k)s offer tax advantages. The 401(k) allows annual contributions of up to $20,500 (as of 2022), with an additional $6,500 for those over 50. Individual Retirement Accounts (IRAs) offer another $6,000, with an extra $1,000 for those over 50. According to Fidelity, 66% of millennials have no retirement savings. Utilizing employer-matching contributions, if available, can significantly boost your retirement fund.

Diversifying Income through Investments

Apart from writing, consider diversifying your income through investments. Stocks, bonds, and mutual funds are conventional avenues. However, emerging options like ESG (Environmental, Social, and Governance) investments are gaining popularity for aligning financial returns with societal impact. According to the Global Sustainable Investment Alliance, ESG investments grew by 15% in 2020.

-

Stocks: Offers high returns but comes with higher risk.

-

Bonds: Provides stable, lower-risk returns; suitable for conservative portfolios.

-

Mutual Funds: Offers diversification; managed by professionals.

-

ESG Investments: Grows by 15% annually; combines profit with social impact.

For more insights on investment strategies, check out these niche targeting tips.

Taking control of your savings and investments can lead to a more secure and predictable financial future.

Conclusion

Effective financial planning is important for any author looking to thrive in the industry. By budgeting wisely, diversifying income streams, and saving diligently, you can build a stable financial foundation.

Key strategies include regular tracking of income and expenses, setting specific financial goals, and maintaining a detailed monthly budget. Diversifying your revenue through traditional publishing, self-publishing, and other platforms can create robust income sources. Additionally, saving for emergencies and investing in retirement accounts can secure your financial future.

Taking control of your finances not only reduces stress but also allows you to focus on your writing. We at Beverly Hills Publishing are dedicated to helping authors succeed both financially and professionally. Learn more about our innovative publishing solutions here.

By embracing these financial strategies, you’ll be well-equipped to navigate the challenges of an author’s career. For more practical tips, explore our resources on author branding.