The cloud computing landscape is evolving rapidly, reshaping how businesses operate and innovate. At Beverly Hills Publishing, we’re closely tracking the major players dominating this dynamic market.

In this post, we’ll explore the current Cloud Market Leaders, their strengths, and what sets them apart in the competitive world of cloud services.

How Big Is the Cloud Computing Market?

Market Size and Growth Trends

The cloud computing market has exploded in recent years, reshaping business operations and scalability. The global cloud computing market grew to $446.51 billion in 2022, with projections indicating a CAGR of 17.43% through 2030.

Grand View Research projects the US cloud computing market to grow at a 13.1% compound annual growth rate (CAGR) from 2023 to 2030. This rapid expansion stems from widespread cloud service adoption across industries, from startups to large enterprises.

Global cloud spending is expected to exceed $599 billion in 2023, up from nearly $500 billion in 2022. This trend underscores the increasing reliance on cloud technologies for business operations and digital transformation initiatives.

Key Market Segments

The cloud computing market splits into three main segments: Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS).

IaaS leads the pack, with AWS dominating this segment due to its extensive services, cost-effectiveness, and superior customer support. The PaaS market is set to grow at an impressive 29.9% CAGR over the next five years, indicating a shift towards more integrated development environments.

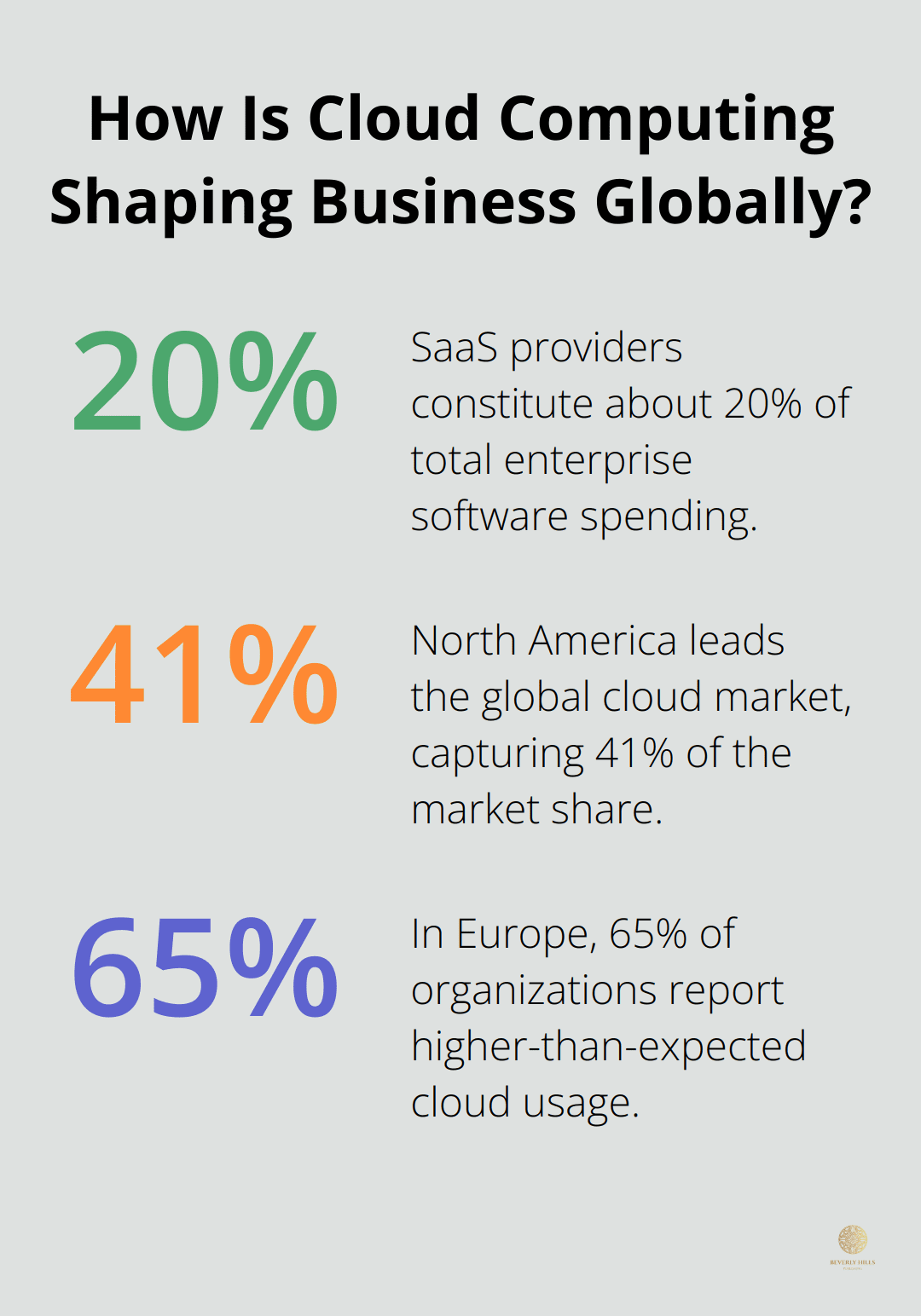

SaaS providers (like Salesforce and Adobe) hold a significant market share, constituting about 20% of total enterprise software spending. This segment continues to expand as businesses seek ready-to-use software solutions for easy deployment and scaling.

Factors Driving Cloud Adoption

Several key factors propel the rapid adoption of cloud services:

- Cost Efficiency: Cloud services eliminate the need for heavy capital expenditures on infrastructure, allowing businesses to operate with more flexibility and reduced overhead costs.

- Scalability: Cloud platforms offer unparalleled scalability, enabling businesses to quickly adjust their resources based on demand.

- Digital Transformation: The push for digital transformation across industries has made cloud adoption a necessity (rather than a luxury).

- Remote Work: The global shift towards remote and hybrid work models has accelerated the need for cloud-based collaboration tools and infrastructure.

- AI and Machine Learning: The integration of AI and ML capabilities in cloud services enhances operational efficiency and automates processes, making these technologies more accessible to businesses of all sizes.

Regional Market Dynamics

North America leads the global cloud market, capturing 41% of the market share. This dominance largely stems from the early adoption of AI and ML technologies in the region.

The Asia-Pacific cloud market is experiencing significant growth, contributing to the overall global market expansion. This growth is fueled by shifts towards digital business models in the region.

In Europe, 65% of organizations report higher-than-expected cloud usage, emphasizing the region’s growing adoption despite regulatory hurdles.

As we move forward to examine the top cloud market leaders, it’s clear that the cloud computing landscape is not just growing-it’s transforming. The next section will spotlight the key players shaping this dynamic market and driving innovation in cloud technologies.

Who Dominates the Cloud Market

Amazon Web Services (AWS): The Undisputed Leader

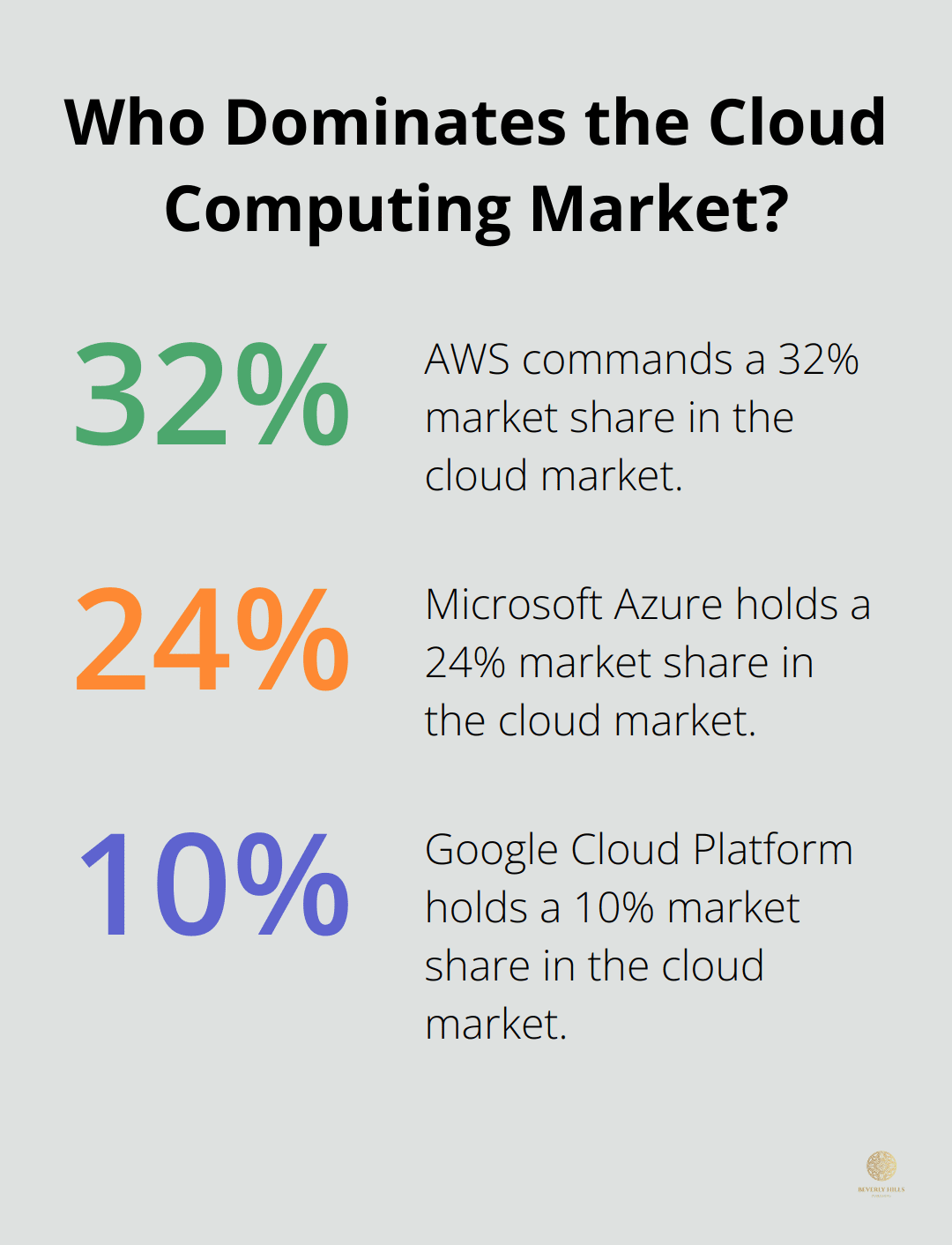

AWS reigns supreme in the cloud market, commanding a 32% market share. Its dominance stems from an extensive service portfolio, which includes over 200 fully-featured services across compute, storage, databases, networking, analytics, robotics, machine learning, and artificial intelligence.

AWS’s strength lies in its ability to cater to businesses of all sizes (from startups to large enterprises). Its pay-as-you-go pricing model and global infrastructure allow companies to scale rapidly without significant upfront investments. Netflix, for example, uses AWS to support its streaming service, handling billions of hours of content delivery each month.

Microsoft Azure: The Enterprise Favorite

Microsoft Azure holds the second position with a 24% market share, particularly excelling in hybrid cloud solutions. Azure’s integration with existing Microsoft products makes it a top choice for enterprises already invested in the Microsoft ecosystem.

Azure’s strength in AI and machine learning services, coupled with its extensive partner network, positions it well for future growth. Companies like Walmart have chosen Azure for its cloud and AI capabilities, demonstrating its appeal to large-scale enterprises.

Google Cloud Platform: The AI and Analytics Powerhouse

While holding a smaller market share of 10%, Google Cloud Platform (GCP) has carved out a niche in AI, machine learning, and data analytics. GCP’s BigQuery and TensorFlow services are particularly popular among data-driven organizations.

GCP’s commitment to open-source technologies and its strong focus on container-based architectures make it attractive to developers and organizations prioritizing flexibility and cutting-edge technologies. Spotify, for instance, migrated its entire backend to GCP, leveraging its data processing capabilities.

Other Notable Players

While AWS, Azure, and GCP dominate the market, other players offer specialized services that cater to specific needs:

IBM Cloud focuses on hybrid and multi-cloud solutions, leveraging its acquisition of Red Hat to provide robust enterprise-grade services. Its strength lies in supporting legacy systems while facilitating digital transformation.

Oracle Cloud has gained traction by optimizing its services for Oracle database environments, making it a strong choice for organizations heavily invested in Oracle technologies.

Alibaba Cloud, while primarily dominant in the Asia-Pacific region, is expanding globally. It offers competitive pricing and specialized services for e-commerce businesses, reflecting its roots in the Alibaba Group.

As the cloud market continues to evolve, these leaders constantly innovate to maintain their positions. For businesses, the choice of a cloud provider should align with specific needs, whether it’s global reach, specialized services, or integration with existing systems.

In the next section, we’ll take a closer look at how these cloud market leaders compare in terms of market share, revenue, and unique selling points. This comparative analysis will provide valuable insights for businesses considering their cloud strategy options.

How Do Cloud Market Leaders Compare

Market Share and Revenue

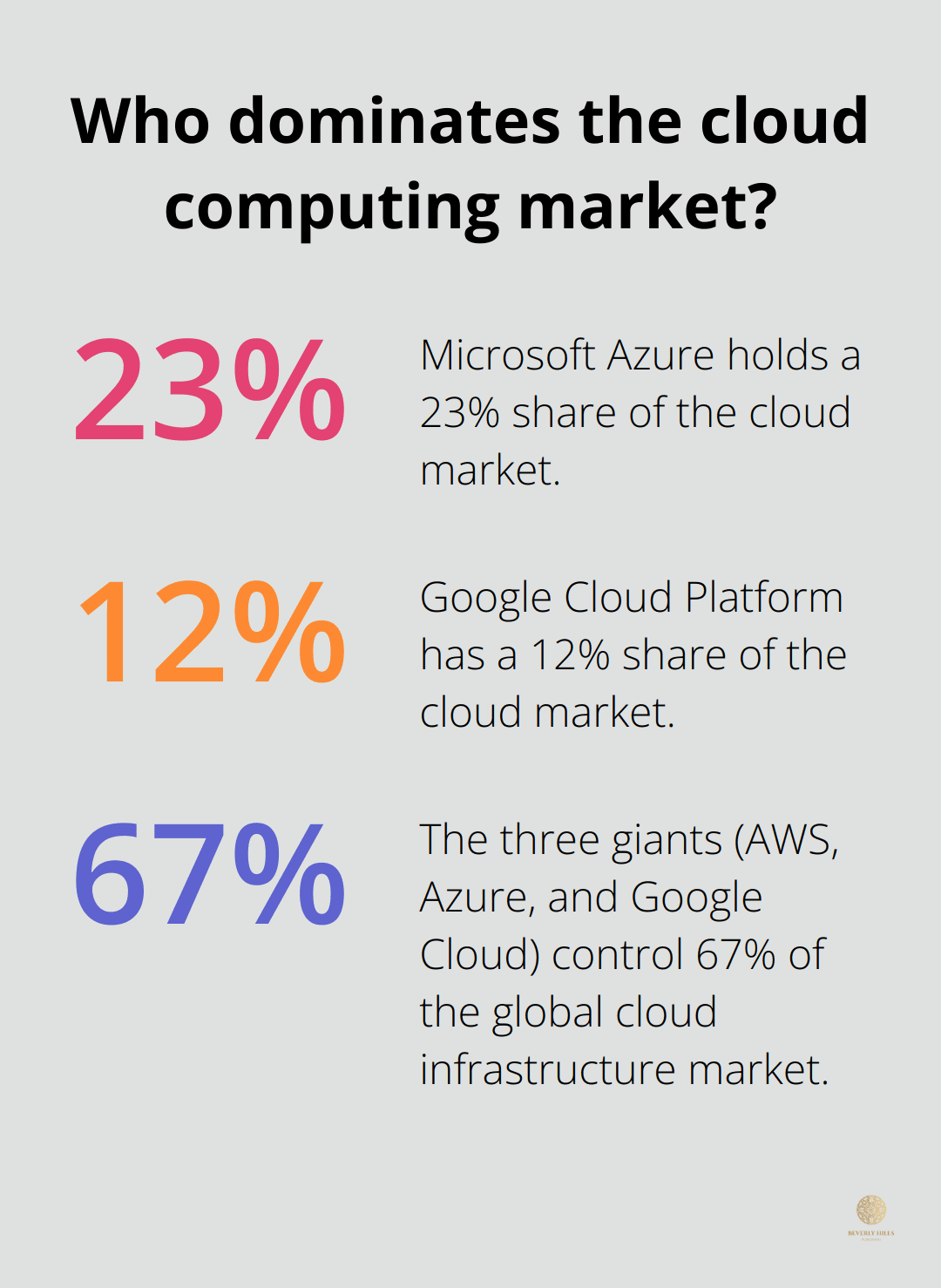

AWS leads the cloud market with a 32% share, followed by Microsoft Azure at 23% and Google Cloud Platform at 12%. These three giants control 67% of the global cloud infrastructure market (according to Synergy Research Group).

AWS reported $23.06 billion in Q4 2022 revenue, a 20% year-over-year increase. Microsoft’s Intelligent Cloud segment (which includes Azure) generated $21.5 billion in the same quarter, up 18% year-over-year. Google Cloud’s revenue reached $7.32 billion, marking a 32% increase from the previous year.

Unique Strengths and Specializations

Each cloud provider excels in different areas:

AWS offers a vast array of services, making it a one-stop shop for businesses of all sizes. It shines in compute power, storage options, and database services.

Microsoft Azure integrates seamlessly with existing Microsoft products, attracting businesses already invested in the Microsoft ecosystem. Azure’s hybrid cloud capabilities appeal to enterprises that want to maintain some on-premises infrastructure.

Google Cloud Platform focuses on data analytics, artificial intelligence, and machine learning. Its BigQuery and TensorFlow services attract data-driven organizations and those implementing cutting-edge AI solutions.

Industry Focus and Customer Base

AWS serves a broad range of industries but has found particular success in media and entertainment, financial services, and healthcare. Companies like Netflix, Capital One, and Pfizer rely on AWS for their cloud infrastructure needs.

Microsoft Azure has a strong foothold in the enterprise sector, particularly in manufacturing, retail, and government. Walmart chose Azure over AWS due to its retail rivalry with Amazon.

Google Cloud Platform appeals to tech-savvy organizations and startups, especially those in the technology, gaming, and digital native sectors. Spotify and Twitter use GCP, leveraging its data processing and analytics capabilities.

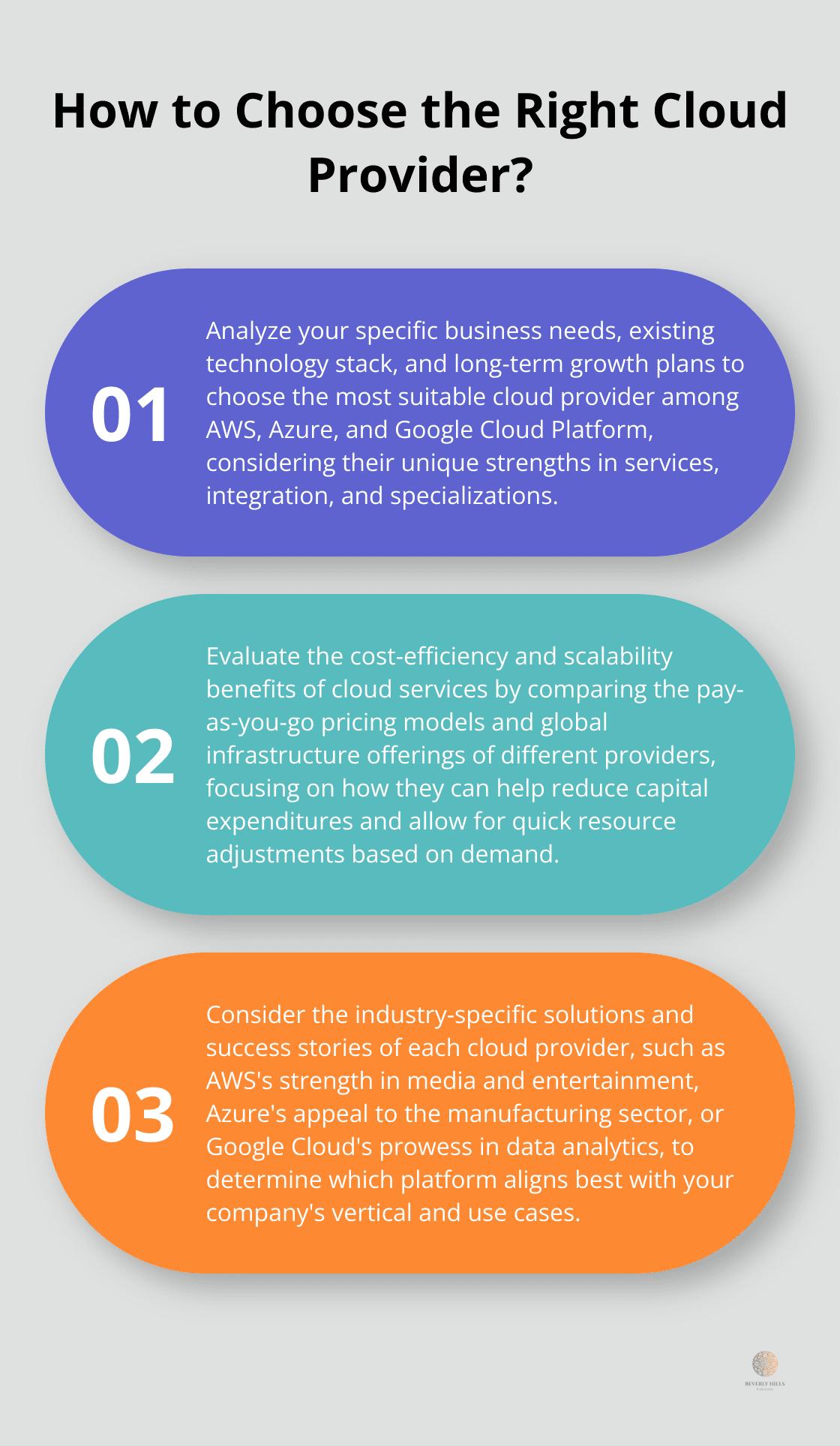

Choosing the Right Provider

When selecting a cloud provider, businesses should consider their specific needs, existing technology stack, and long-term growth plans. While the big three dominate the market, other players (like IBM Cloud, Oracle Cloud, and Alibaba Cloud) offer specialized services that might better suit certain organizations.

The choice of cloud infrastructure should align with a company’s commitment to innovation and global reach. This ensures the delivery of cutting-edge solutions to clients worldwide.

Final Thoughts

A few cloud market leaders dominate the landscape, with AWS, Microsoft Azure, and Google Cloud Platform at the forefront. These giants offer unique strengths and specializations to meet diverse business needs. As the market expands, we expect these leaders to maintain their positions through continuous innovation and adaptation to emerging technologies.

Selecting the right cloud provider is a critical decision for businesses of all sizes. The choice impacts operational efficiency, scalability, and innovation potential. Companies must align their cloud strategy with specific needs, growth plans, and existing technology stacks to maintain a competitive edge in today’s digital-first world.

At Beverly Hills Publishing, we recognize the importance of staying ahead in the rapidly evolving digital landscape. We help authors establish themselves as industry leaders through our publishing and branding strategies. The cloud is no longer just an IT decision – it’s a business imperative that can drive growth and success.